Raising NH gas tax

Currently, the New Hampshire gas tax is set at 22.2 cents per gallon. This year, the Legislature will consider HB 538, a bill that would raise the tax to 28.2 cents per gallon. That revenue would go to fix state roads and bridges.

How the gas tax is used

2014 was the last time New Hampshire raised its gas tax. Money from that tax hike is used to pay back a $200 million federal loan to widen segments of Interstate 93. The money has also helped resurface nearly 900 miles of roadway and begin work repairing or replacing 23 bridges, according to a report by the New Hampshire Department of Transportation.

Fixing “red list” bridges

New Hampshire has been working in recent years to reduce the number of structurally deficient bridges. A tally released last year showed there to be 385 structurally deficient bridges in New Hampshire – 252 owned by municipalities and 133 owned by the state.

If passed, the tax hike would take effect in July.

Learn more about New Hampshire’s gas tax

Pros and cons

Proponents argue that now, more than ever, the state needs money to fix roads and bridges that have fallen into disrepair. Raising the gas tax is a good way to collect the needed funding from actual users of these roads and bridges. The gas tax helps New Hampshire remain free of sales and income taxes.

Do you support a bill to raise the gas tax by 6 cents to help pay for NH roads and bridges?

Discussion held on Citizens Count website and Facebook page January 19, 2019

No: 331 people were opposed to raising the gas tax.

- “Where's all the money that we're already paying in taxes going? We're already getting taxed enough. No more nickel and diming - the government needs to live within its means rather than preying on hard working folk for every frivolous little project they dream up.”

- “The gas tax already pays for the roads and bridges. The problem is that politicians keep finding other things to blow the money on… The fact is government can't even do roads well, just like everything else government makes a complete mess of. The incentives are all wrong.”

- “No more gas taxes until that money is used for roads ONLY. A bill that would've guaranteed that the gas tax could only be used for roads was killed in the house in 2014. This isn't a rainy day fund.”

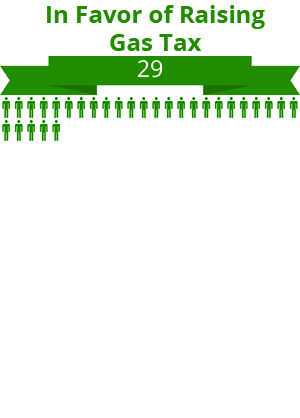

Yes: 29 people were in favor of raising the gas tax.

- “I am far from wealthy and I do not have a very efficient vehicle. I do, however, realize that you got to pay to play. Until technology catches up, we gotta tax gas. It's the fairest thing I can think of.”

- “Yes. The price of gasoline is low so now is the time to keep the roads and bridges in good condition.”

- “Who better to pay for the repair of New Hampshire's roads [than] the people that use them?”

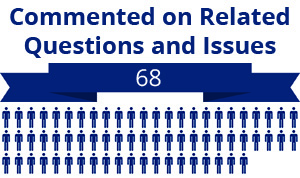

Other: 68 people commented on related questions and issues instead.

These included:

- Consider the future: “As vehicles become more fuel efficient, less and less taxes will be collected. Electric and hybrid vehicle owners pay the least for the roads on which they drive. The current system is getting less equitable, and less sustainable.”

- Consider alternatives: “Pass legal marijuana and we will have plenty of tax dollars. Take a look at the excess funds Colorado has now.”

- Prioritize efficiency: “Depends. Before any tax increases I’d like to see an audit of the programs using the existing funds to ensure there’s nothing else that can be done to reduce the costs.

*Editor selection of actual participant quotes.